Energy Global Recap 2023 and 2024 Perspectives with our Best Wishes for the New Year

As every year, we are pleased to share with you our Energy Global Recap 2023 and 2024 Perspective with our Best Wishes for a New Successful Year.

By Energy sector, we understand the conventional Oil & Gas (Upstream, Midstream), the Refining & Petrochemical (Downstream), and the Energy Transition.

This Energy Transition sector is covering:

- Renewables (Wind, Solar)

- Decarbonation (Carbon Capture, Electrification, Hydrogen, eAmmonia, eMethanol, Renewable Natural Gas (RNG), BioDiesel, Renewable Diesel, Sustainable Aviation Fuel (SAF), more…)

- Recycling (Waste-to-Chemical, Waste-to-Plastic, Waste-to-Hydrogen, Waste-to-Energy)

All our figures come from the interactive database www.projectsmartexplorer.com where we trace projects from the pre-front end engineering and design (pre-FEED) and front end engineering and design (FEED). We select projects when they have serious chance to materialize with two thresholds:

- above $100 million capital expenditure (Capex) for Oil & Gas and Refining & Petrochemical

- above $10 million Capex for Energy Transition as this market is still driven by quantity of demonstrators and pilot projects

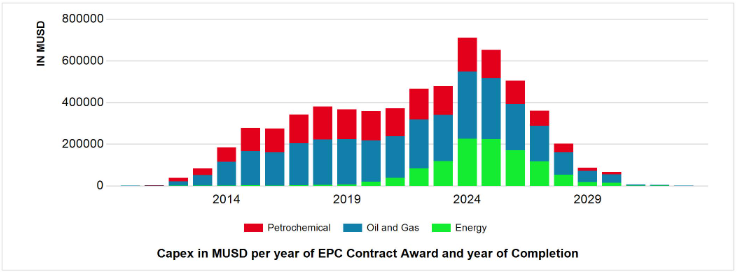

Based on these definitions, the barre graph below represents the investments year per year in these three sectors.

From this picture, we can see how the investments in Oil & Gas and Refining & Petrochemical projects are not slowing down while they are booming in Energy Transition. If the graph decreases after 2024, it is just because it reflects the visibility we have on future projects at a given date. The further we look, the less visibility we have. Anyway, never the ambition of the operators to invest in new projects has been so high on the next coming three years.

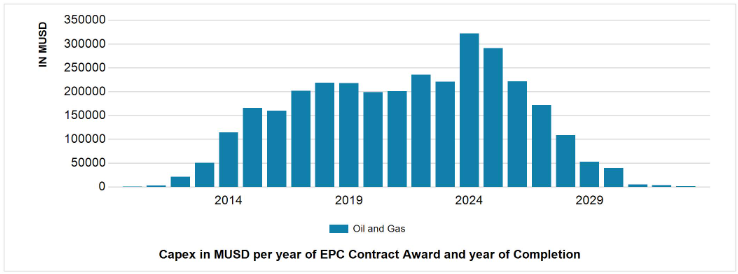

Oil & Gas Projects Outlook

If we focus on the Oil & Gas Projects, Upstream and Midstream, the trend remains positive despite the COP 28 decision to phase out the fossil energies.

For now, the crude oil consumption continues to grow every year up to 102 million barrels per day (b/d) in 2023. In addition, the global demand still increases, mostly due to emerging countries. Various scenarios anticipate a stabilization in 2030 for a couple of decades before an effective slow down.

In the meantime, the Oil & Gas fields currently in production will deplete. They will require massive investments for the replacement of the missing capacities to meet the global demand. In this context, there is no surprise, that investments stand at their upper level, especially in deep offshore projects.

Regarding the gas, the situation is even worst or better depending which side we look at it. The structural demand for gas is following the same curve as crude oil. But in addition, the gas projects benefit from two conjunctural phenomena:

- The relocation of the sources of supply because of the Ukraine war

- Its transitional role with coal.

In addition, the COP 28 first decision to stop flaring gas will have major consequences on new investments in installed bases, not only to capture this methane, but also to store it and transport it.

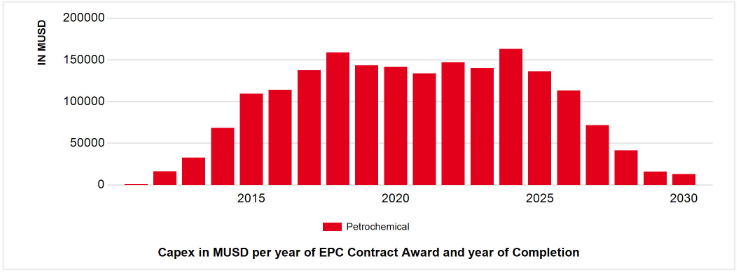

Refining & Petrochemical Projects Outlook

On the Downstream side, Refining & Petrochemical projects remain at their upper level too in 2023. The perspectives for 2024 look even better as illustrated by the barre graph below.

During Covid period, the investments in Refining & Petrochemical projects stabilized. The uncertainty on the future demand was of course a key question. But then, the new requirements to decarbonate this industry started to puzzle investors about potential impact on projects profitability.

In 2023, the situation started to clarify on the available technologies to be integrated. In parallel, most of the governments released their tax incentive programs to decarbonate these industries.

Last point, US, Europe and large countries in Middle-East or Asia have initiated new regulations and tax schemes to relocate manufacturing activities at home instead of importing corresponding goods and equipment. These new manufacturing policies impact directly the petrochemical industries since plastic and chemicals stand as the first building blocks of any manufacturing activity.

Therefore, the Refining & Petrochemical production units will need to relocate as well as a key ring of the manufacturers supply chains, fueling investments on the next decade.

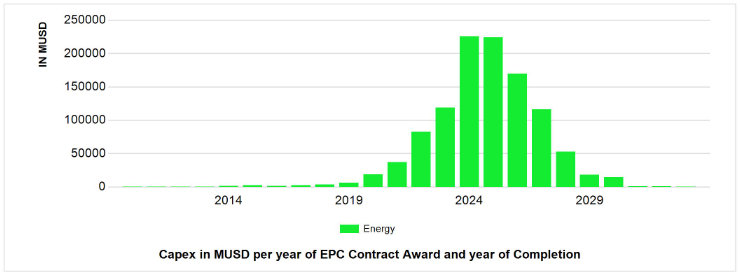

Energy Transition Projects Global Outlook

As mentioned above, Energy Transition includes three very different types of projects (Renewables, Decarbonation, Recycling).

At the difference with conventional energy sectors, Energy Transition is evolving exponentially on these years.

Again, the graph drop in 2025 and beyond does not reflect a decrease of investments but the difficulty to detect these projects years ahead.

Until 2019, Energy Transition was synonymous of Renewables (Solar, Wind). But since that time, engineers developed new solutions for Decarbonation and Recycling, stimulating projects and attracting investments. So far, many of them are still demonstrators or pilots projects, but step by step, we observe large scale industrialization of these technologies.

This deployment boosts Capex to unknown levels, so much that they should exceed investments in Refining & Petrochemical in 2024. Therefore, Energy Transition is no longer a marginal segment, but a full size market.

As indicated on the picture above, the perspectives for 2024 and 2025 appear very high compared with 2023. On one side it is clear that number of these announced projects will be postponed or delayed, but on the other side, quantity of new projects will popup along the year in this category.

Oil & Gas – Refining & Petrochemical – Energy Transition Overall Trends

In conclusions, we should summarize this Energy Global Recap 2023 and 2024 Perspective as following.

The investments in conventional energy projects such as Oil & Gas, Refining & Petrochemical continued to grow in 2023. The perspectives for 2024 remain robust, mainly because of a sustainable global demand and the coal phase out.

On Energy Transition projects, the dynamic is far different as investments double on year to year approximately. Even if Offshore Wind faces turmoil at this moment, Solar, Decarbonation and Recycling race up with strong tailwind, especially since the COP 28 recognized formally Carbon Capture as an acceptable solution for carbon dioxide (CO2) unabated processes.

These projects come on the top of the already huge conventional business in Oil & Gas and Refining & Petrochemical. They offer historical opportunities for growth and profits to contractors and manufacturers at a period some other industries such as Real Estate, Construction, Textile and Automotive are slowing down.

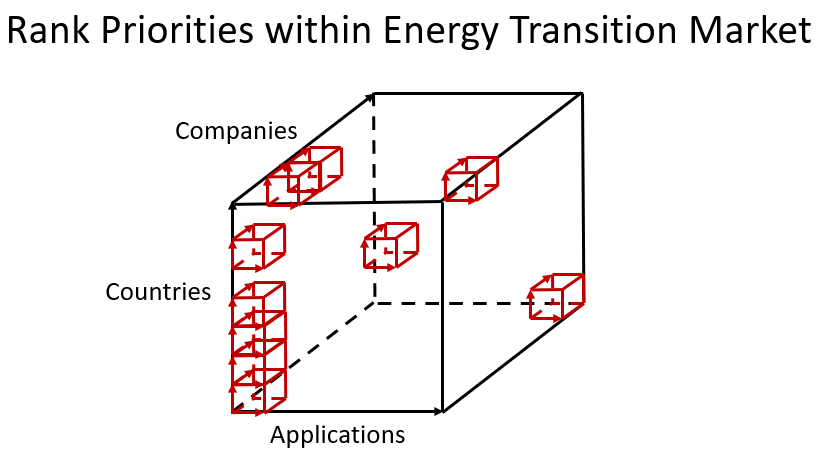

Most of these projects run on fast-track at the initiative of operators coming from all horizons with new expectations. They require a different approach with different organizations. To work effectively on this new type of projects, the first step starts by acquiring a comprehensive vision on this market to identify the key players, the key applications and the key countries. The second step goes by implementing a 3 dimensions approach (Company, Application, Country) to rank priorities among projects opportunities.

Energy Transition market is no longer a marginal business, you cannot afford to miss it unless you accept to leave the entire energy sector. We expect that this Energy Global Recap 2023 and 2024 Perspective was instructive for you, for more details and actions we wish you a successful New Year with www.projectsmartexplorer.com.