Oil & Gas Global Recap 2022 and 2023 Perspectives with our Best Wishes for the New Year

As usual in this period, we like to share with you our Global Recap 2022 and 2023 perspectives with our Best Wishes for the New Year.

In 2022, we saw how the tensions on the energy markets, exacerbated by the Ukraine war, stimulated investments in Oil & Gas and Petrochemical. These tensions did not start with the Ukraine war, but during the Covid period with the financial institutions preventing financing fossil fuels projects.

The picture below shows the amount of capital expenditure (Capex) per year in Oil & Gas greenfield and brownfield projects. Here we consider only projects of a size above $100 million Capex.

On this barre graph, we can see how the investments in old or new projects stabilized between 2018 and 2021. The problem is that in the meantime, the Oil & Gas consumption did not slow down, it ran around 100 million barrel per day (b/d) for the oil and increased by 20% for the natural gas.

In addition, maintaining the plateau production in existing Oil & Gas fields requires investments to avoid their depletion.

In conclusion: in 2022, the Ukraine war sparked an energy crisis which was already latent. It also amplified it by requiring to reshuffle the sources of supply from East to West and the transportation means from piping to shipments.

Therefore, Western economies had to reinvent the entire Oil & Gas value chain from-well-to-wheel, pushing up investments in Oil & Gas projects to historical highs in 2022.

But, how does it come that Oil & Gas consumption stands that high ?

In this Global Recap 2022 and perspectives we can find some answers on the Downstream side.

Refining and Petrochemicals Global Outlook and Robust Perspectives for 2023

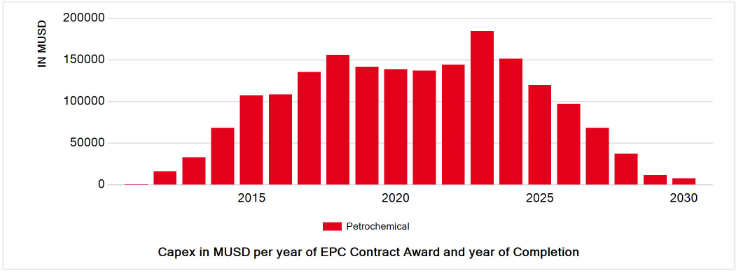

As illustrated below, we observe how much the refining and Petrochemical demand remains robust over the years. The barre graph below reflects the Capex, year per year, in the refining and Petrochemical projects. As for Oil & Gas, we consider here only the projects of a size above $100 million Capex.

From this graph, we can notice how much these investments were stable during the Covid period and how robust are the future perspectives.

Oil & Gas resources may be used for themselves for electricity production, heating or cooking. But most of the other applications suppose heavy transformations, through refining and Petrochemical processes, for transportation, manufacturing industries, building construction, chemicals, personal health & care and many others.

In fact, except for the transportation sector, which was paralyzed during the Covid, the global demand in most of the other sectors remained robust over the last years, calling for new investments in 2022.

As a matter of fact, the global demography is fueling the demand for hydrocarbon products, thus refining and Petrochemical investments, especially in Middle-East, Africa and Asia.

Demography drives the Petrochemicals Investments

With 80 million new inhabitants, the equivalent of Germany population, coming on earth every year, the demand for housing, clothes, health care and all kinds of manufacturing goods increases mechanically in the same way. In addition, the standards of living of existing populations improves as well, calling for always more hydrocarbon products even if recycling processes emerge.

The green dots on the map below illustrate this correlation with the Petrochemical projects engineering, procurement and construction (EPC) contracts awarded in 2022 in Middle-East, Africa and Asia.

In addition to this hydrocarbon products demand growth, the Ukraine war triggered large integrated refinery-Petrochemical projects in Asia at the initiative of Middle-East operators to secure their biggest downstream market against a potential competition with Russia in that region.

Regarding USA, the phenomena is different as the Petrochemical projects sanctioned in 2022 reflect the success of the relocation policy in this country. In that respect, the difference between USA and Europe is significant where EU relocation still remains a dream for now.

In opposite way, Europe leads the game for designing and building these projects as represented by the concentration there of orange and red dots representing the engineering companies offices working on these projects for front end engineering and design (FEED) and EPC.

Petrochemicals Demand and Ukraine War boosted Oil & Gas Projects in 2022

The demand for Petrochemical products and the Ukraine war boosted the investments in Oil & Gas projects all over the World in 2022 as illustrated by the picture below.

All the regions benefited from this wave of investments after financial institutions realized that blocking carbon financing was no longer sustainable.

Liquefied natural gas (LNG), pipelines, floating production storage and offloading (FPSO) projects led the game to meet the global demand. Anyway, the lack on investments on the past years will not be compensated soon, the unbalance between production and consumption is here to stay some years more, especially to replace Russia Oil & Gas supply.

From this Global Recap 2022, the Oil & Gas and Petrochemical perspectives look bright for coming years, so, we wish you an Happy New Year and great successes in 2023 with the support of the new version of www.projectsmartexplorer.com