Oil&Gas and Petrochemical Projects Global Outlook on 1st Half 2023

On this news we propose you the energy projects global outlook on 1st Half 2023 in beginning with the Oil&Gas and Petrochemical sectors.

As first conclusion, the investments in Oil&Gas and Petrochemical stood robust on first half 2023. In this www.projectsmartexplorer.com database, we consider projects all over the world above $100 million capital expenditure (Capex). Then, we trace them as early as the pre-front end engineering and design (pre-FEED) stage.

In doing so, monitoring all these investments day by day gives us a unique source of information to detect market trends. It may be per country, per company, per application, per year.

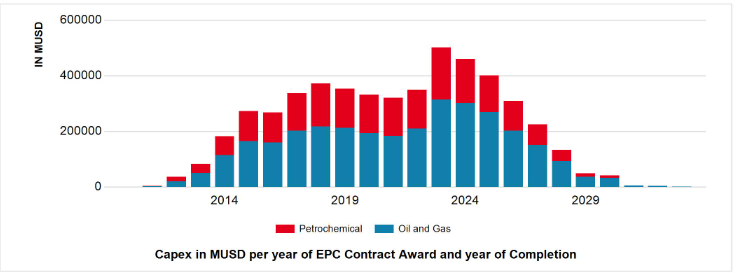

In that respect, the barre graph here below represents the Capex per year in K$ of all the Oil&Gas and Petrochemical projects.

Between 2021 and 2023, the investments are ramping up. They translate operators’ ambitions to meet the surging global demand after the Covid. Since 2023, the Capex decrease reflects our vision on future projects. In fact, the further we look, the less visibility we have on projects.

Thus, the market is not about to decline.

Robust Oil&Gas and Petrochemical Investments on 1st Half 2023

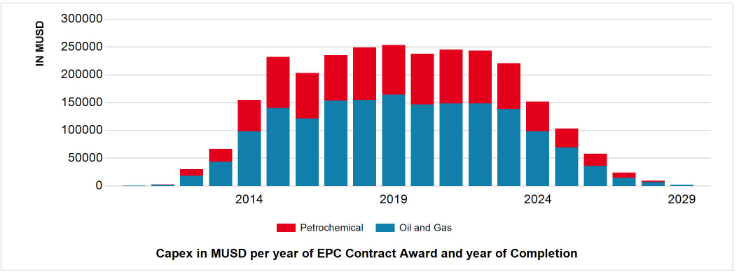

Compared with the forecast above, the barre graph below is showing the actual situation. In this picture we consider only the projects where the engineering, procurement and construction (EPC) contracts have been awarded.

On this barre graph, the 1st Half 2023 is getting close to the entire year 2022. In addition, the volume of Capex engaged for projects execution in 2024 is already above half of 2022.

Therefore, even if series of projects lay be delayed or postponed on 2nd Half 2023, this year should exceed 2022 by 10 to 15%.

Energy Transition Projects Global Outlook on 1st Half 2023

According to our definition, Energy Transition projects include three categories of projects.

- Renewables: Solar, Wind, Water

- Decarbonation: Electrification, CCUS, Hydrogen, eAmmonia, eMethanol, BioDiesel, Renewable Diesel, eFuels, Renewable Natural Gas (RNG), Sustainable Aviation Fuel (SAF), …

- Recycling: Waste-to-Chemical, Waste-to-Hydrogen, Waste-to-Methanol, Waste-to-Plastic

These projects differ from Oil&Gas and Petrochemical sector as we see there quantities of pilots and demonstrators as small as $10 million Capex.

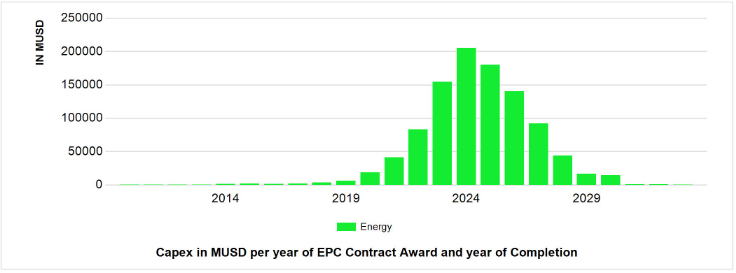

Anyway, Energy Transition market has no equivalent in history as illustrated by the picture below.

This curve shows how this market has emerged in a couple of years to rival with Oil&Gas and Petrochemical in term of Capex. In 2023, it should engage $150 billion Capex, exceeding Petrochemical sector investments for the first time in history. And obviously, it will not stop there.

As in the barre graph above, the fact that investments go down after 2024 does not means a market decrease but the lack of vision we have on future projects. The further we look, the less visibility we have on projects to come.

Bullish Energy Transition Projects on 1st Half 2023

If Oil&Gas and Petrochemical sector is rather conservative with well-known operators running projects on long cycles, Energy Transition appears far different in 1st Half 2023.

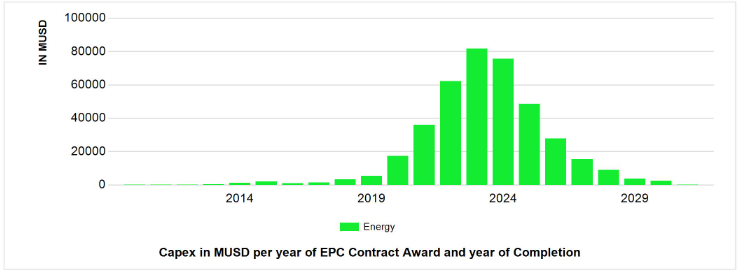

A new generation of operators pops up as illustrated by the curve below showing the EPC contracts awarded in Energy Transition on 1st Half 2023.

Since 2019, the volume of Capex invested in awarded EPC contracts for Energy Transition projects has more than doubled year to year. In 2023, it should continue on the same way as the 1st Half is already exceeding the 12 months last year. In addition, the volume of projects already awarded in 2023 for execution in 2024 is also passing the full year 2022.

Therefore, this trend of a market doubling every year should continue still some years until it reaches a plateau. Interestingly, these Energy Transition investments are not substituting Oil&Gas and Petrochemical Capex, but come on the top of them. This accumulation of investments contributes to the tensions on the supply chain. Most of engineering companies, contractors and manufacturers are fully booked for months if not years.

Game Changers Take over the Historical Leaders

On this 1st Half 2023, the offer for Oil&Gas, Petrochemical and Energy Transition resources is lagging behind the demand. In practice, the market is ramping up in uncontrolled manner attracting every day new players from other sectors or just built-on-purpose. These new comers appear in green in the picture below.

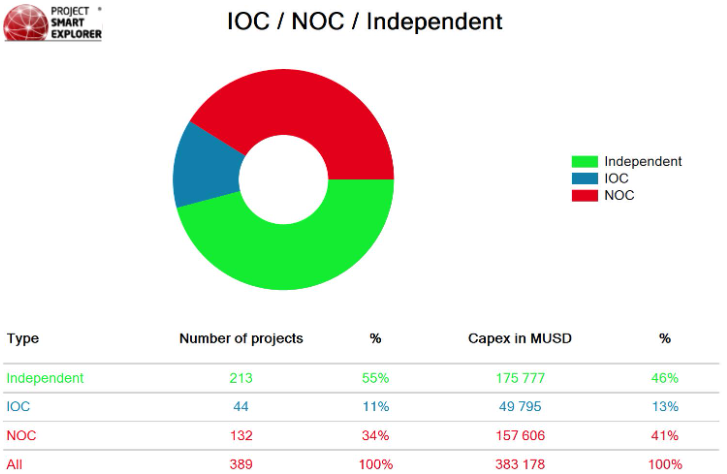

For the first time in history, the Independent Companies are taking over the market with 46% of the Capex on the last 6 months. National Oil Companies (NOCs) rank number 2 with 41%. And the International Oil Companies (IOCs) lag behind at only 13% market share in term of investments.

These figures reflect major changes in the market. Not only the Independent Companies are growing faster that NOCs and IOCs, but they pass them also in Capex and market share. They are the game changers of the Oil&Gas, Petrochemical and Energy Transition industries, and you can’t ignore them anymore.

To know who these game changers are, where they stand, just have a look into www.projectsmartexplorer.com