Challenges in Scaling Up Hydrogen Projects

Introduction

Hydrogen has been used for decades in industry, especially to produce ammonia and methanol.

For the last few years, especially since Covid, Hydrogen has been enforced like the fuel of the futur. In fact, the Production of Green Hydrogen via electrolysis (produced with renewable electricity) is a vector of decarbonation.

Also, the combination of Green Hydrogen with Carbon Capture can create alternative fuels without the extraction of new fossil material.

Main Scaling Challenges

Technology Readiness

The Technology Readiness Level (TRL) of electrolyser technologies, especailly for large-scale green hydrogen production unit above 50MW, remains a key bottleneck in the deployment of hydrogen projects.

Alkaline electrolysers are relatively mature (TRL 8-9), but newer technologies such as PEM (Proton Exchange Membrane) and solid oxide electrolysers are still evolving, often at TRLs between 6 and 8. These less mature systems face challenges and questionability in terms of long-term durability, scalability, and integration with variable lectrical renewable energy sources.

Those uncertainties generate hesitation among investors and operators, slowing down decision-making and leading to delays in permitting, procurement, and construction phases.

Additionally, the limited number of proven profitable large-scale green hydrogen projects increases project risk making financing more difficult.

Green Hydrogen facilities are facing the same challenges as any other industries when it comes to scaling up production capacities, passing from pilot to industrilization.

For the moment, using hydrogen from electrolyzers is a process that is not mature from a market perspective to be associated in the process idnsutry, like refining or steel. It is easier to use blue or grey hydrogen compared to green hydrogen.

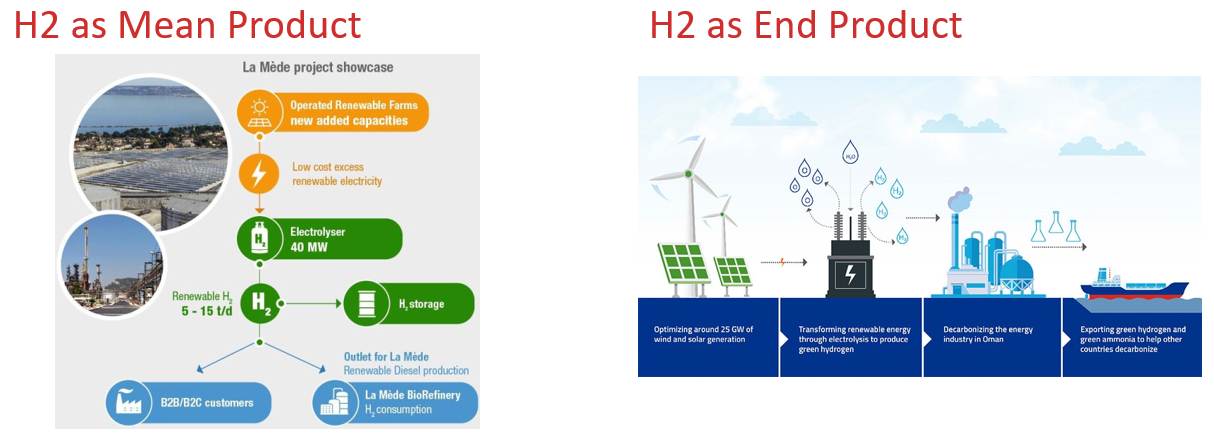

On the contrary, the usage of green hydrogen with the final objective to produce carbpn neutral alternative fuels is meeting its market little a little, and offer a quick moneytization of green hydrogen.

Infrastructure Bottlenecks

The distribution of green hydrogen is also a problematic. First because hydrogen being the smallest molecules possible, it leaks through most of existing distribution infrastructure.

Thus, the distribution of Hydrogen among various production hubs requires a dedicated network (pipeline and storage). Currently this distribution network does not exist and has no reason to exist before reaching the industrial scale.

To motivate such an investment in infrastructure, the industry needs to reach maturity in the Gigawatt (and more) of Electrolyzers capacity as well as expand its usage of clean fuels.

Regulatory Framework

The regulatory framework for green hydrogen is still in its early stages and remains fragmented across regions, not to say countries.

This incoherent ecosystem creates uncertainties for developers and manufacturers of the supplychain who need to invest in R&D.

While some progress has been made, such as the EU’s definition of renewable hydrogen under the Delegated Acts and Guarantees of Origin, crucial parts are still missing such as certification standards (IOS or IEC), trade rules, electrical grid access, and support mechanisms to fund the projects.

From one election to another, as we witnessed in USA, the financing and regulations can be inconsistently applied.

This regulatory immaturity complicates project planning, delays investment decisions, and limits the scalability of green hydrogen initiatives. Without clear, stable, and harmonized policies, many projects face uncertainty around compliance, funding eligibility, and long-term viability, ultimately slowing down market deployment.

At the moment, it is a chicken/egg situation with : standards waiting the return of experience from projects, and projects waiting for a more mature standard guidance.

Cost Competitiveness

We distinguish hydrogen depending on its production process thanks to a color code:

Grey hydrogen is extracted from natural Gas. When a Carbon Capture unit is added, Grey Hydrogen becomes Blue Hydrogen. Green Hydrogen comes from the electrolysis of water thanks to renewable electricity.

For the time being, costs differ greatly depending on the type of Hydrogen produced.

Grey is the cheapest, costs at 1-2$/kg.

Blue Hydrogen sees its cost reaching 2-3$/kg.

When Green hydrogen currently costs between 3-6$/kg for the ebst in class.

For companies, using hundreds of thousand of tonnes per year, the gap in price on top of the need for a new investment don’t want to kill their profitability. Little a little, we see western companies starting to invest in Green Hydrogen despite the additional cost, as part of their budget toward reducing their carbon footprint. Also quite often supported by public money.

Market Demand Development

Blue or Green hydrogen comes with a premium on costs but can also create more value depending on the market opportunities. Like every innovation the market is currently not able to offer this premium as the demand for clean hydrogen is not raising fast enough.

But in our case, there are two main paths to create an End-use market for Green Hydrogen: having the supply chain ready to pay the premium or impose its utilization via a legislative framework.

Currently, the European Union is creating the first basis for an economic market to exist via regulations on Sustainable Aviation Fuel (SAF). Forcing the jetfuel market to have a portion of clean fuel integarted force the usage of green or blue hydrogen. The International Maritime Organization (IMO) is following a similar path with ambitious targets on the usage of green fuels among ships by 2030.

Current Industry Initiatives

The transportation of Hydrogen is complex due to the size of its molecule, which also give hydrogen the disadvantage to be a low energy density gas. It must be compressed to be efficient and energy dense enough, making it even smaller with increasing risk of leakage. It can also be liquified to a temperature close to the absolute zero which is problematic because high energy consuming.

Therefore, to solve this issue of transportation, the production of Green Hydrogen isoften made close to the final usage, hence calling for the creation of various industry hubs.

Currently, the best solution to track these projects is to use dedicated plateformes like www.projectsmartexplorer.com

Conclusion

The recent concern and awareness on reducing our CO2 emissions makes Hydrogen a central element of Energy Transition.

Despite the climate urgency, its development must face an industrial reality that can hardly be accelerated. Scaling from a few Megawatt of Electrolyzer capacity to the Gigawatt will require engineering resources and time to create the right ecosystem.

Interested in knowing more about Energy Projects?

2b1st Consulting is supporting companies working on Energy projects with data, expertise and network. Our experts have extensive knowledge of projects and have access to an unique granularity for all valves and pumps manufacturers.

If you want to know more about projects subscribe to our newsletter or contact us at Ask a demo